This year tested everything: our assumptions, our patience, our business models. Through 64 essays, I tracked where AI, real estate, and venture capital collided, converged, and cracked open new ground.

Here’s what 2025 looked like through my lens.

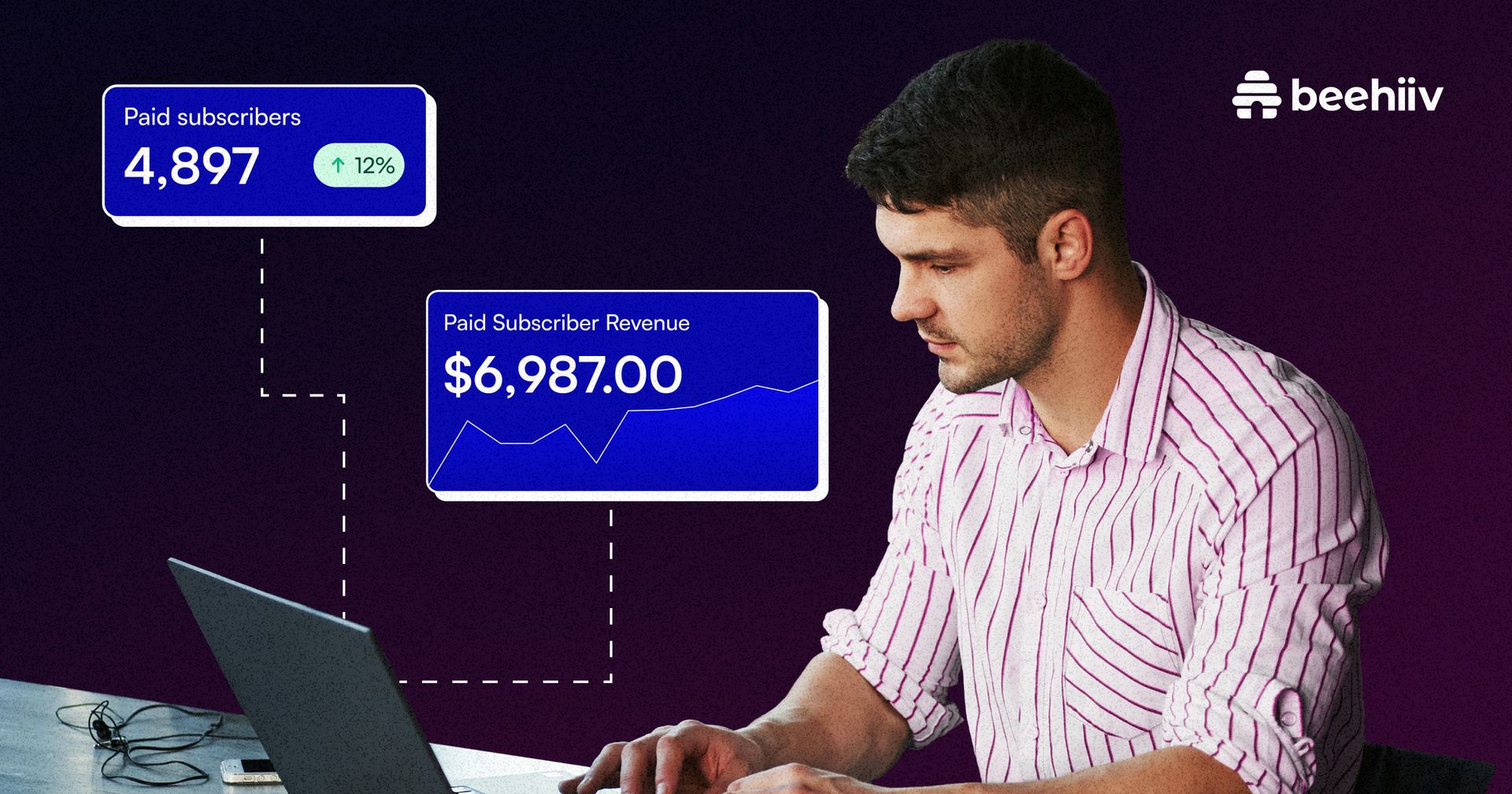

This newsletter you couldn’t wait to open? It runs on beehiiv — the absolute best platform for email newsletters.

Our editor makes your content look like Picasso in the inbox. Your website? Beautiful and ready to capture subscribers on day one.

And when it’s time to monetize, you don’t need to duct-tape a dozen tools together. Paid subscriptions, referrals, and a (super easy-to-use) global ad network — it’s all built in.

beehiiv isn’t just the best choice. It’s the only choice that makes sense.

AI: From Buzzword to Infrastructure

AI is no longer a feature. It’s the infrastructure layer.

This year, we crossed the threshold.

Social trust collapsed. In January, I wrote that 75% of users can’t tell AI-generated content from real. That wasn’t a stat. It was a warning.

Answer Engine Optimization (AEO) replaced SEO. I said brands must get quoted, not just found. Real estate search now starts and ends with AI answers, not portals. Zillow isn’t a site. It’s a signal.

The AI Ouroboros revealed itself. Big Tech built a trillion-dollar loop. Data feeds compute. Compute feeds models. Models feed power.

Compute became geopolitical power. Chips, not missiles, are redrawing alliances. Nations that control compute will control the future.

PropTech: The Graveyard, the Mergers, the Shift

PropTech matured this year. That meant death for many, rebirth for a few, and consolidation for the rest.

I named the failures. In The Real Estate Tech Graveyard, I mapped the common cause of death: ignored agents, bad timing, and no distribution.

Compass + Anywhere was real estate’s “cap moment.” The merger wasn’t about brand. It was about brokerage finally going efficient.

Rocket + Redfin (hypothetical) showed scale’s power. My model said this combo could control 1 in 6 purchase mortgages. That’s not synergy. That’s a shift.

Kaz Nejatian reframed iBuying. The future isn’t flipping homes. It’s building infrastructure for housing liquidity.

Listing wars escalated. The scorched-earth tactics scorched trust. The new winners will build outside the battlefield.

Venture Capital: Split in Two

This year, venture split down the middle.

AI got funded. Everything else waited. In The Great Divide, I showed how one sector moved at warp speed while the rest ran on fumes.

VCs became operators. Founders asked for more than checks. I called it the new operating model: build, buy, hold.

Allocators shaped the narrative. I shared how sitting on both sides of the table—GP and allocator—forced sharper decisions.

Diligence failed us. I told VCs: stop reading. Start clicking. The best founders don’t always write the best decks.

The Edge of Emerging Tech

2025 wasn't about hype. It was about proof.

Quantum computing started reshaping real estate. It’s not theory. It’s changing where we build and what gets built.

Stablecoins got federal backing. The GENIUS Act passed. If your brand isn’t ready for branded currency, you’re already behind.

SaaS is over. AI agents are here. In PropTech and FinTech, the future isn't tools. It's delegation.

MLS must adapt or die. I said every MLS exec needs to understand Model Context Protocol—before someone else builds the first server without them.

Leadership, Bias, and Purpose

Not everything was technical. Much of this year was personal.

78 Days In made me ask: What am I building? What am I giving up to build it?

I said VCs need side quests. Raising capital and running Tough Mudders aren’t that different. Both require grit.

Andre Iguodala taught me how selfless founders build dynasties. I call them dynasties, not unicorns. They last longer.

Diversity, Adversity, and the Investment Lens

I don’t invest in pitch decks. I invest in people who’ve been through it.

Power Forward LA reminded me why representation isn’t window dressing. It’s infrastructure.

AAPI Night at USF wasn’t a photo op. It was family.

I wrote “Not Random, Just Rigged.” VC isn’t broken. It’s working exactly as it was designed to—against most people.

The Philippines stays on my mind. I still believe we can fix housing in Southeast Asia by backing local infrastructure, not global branding.

PMF Lessons From Real Life

Chickenjoy and Jollibee showed how a category is built by culture, not consultants.

Furnishr proved you can turn empty rooms into finished products. Consumers want convenience, not catalogues.

Boardy.AI taught me what happens when you let an AI broker your intros. Spoiler: they’re better at pattern matching than you think.

ARKI is quietly becoming the AI OS for the built world.

Tactical Advice for Founders

Don’t chase high valuations early. In PropTech, early overpricing kills your next round.

Fall MVP beats Spring MVP. You don’t need perfect. You need momentum.

Future-proof now. If your product doesn’t work for my kids’ generation, it won’t matter if it works today.

What 2025 Taught Me

Across 64 essays, here’s what stuck:

AI is infrastructure. Not a tool. Not a feature. It’s the new foundation.

Distribution beats innovation. Every. Single. Time.

Capital is consolidating. In venture and in real estate.

Leadership is the edge. In an AI world, your human traits are your alpha.

The future isn’t next. It’s now. Quantum, stablecoins, agents, AEO—they’re here.

What I’m Watching in 2026

Whether AEO becomes the new brand moat

If the PropTech M&A wave keeps rolling

How the venture capital divide resolves or deepens

What happens when agents turn autonomous

If we can build capital systems that include more people

Thank you for reading, sharing, and calling me out when I needed it.

Here’s to another year through the looking glass.

xoxo.

Maximillian Diez,

GP, Twenty Five Ventures

If this writing adds clarity or connection to your week, consider supporting the newsletter. Every contribution helps keep the work thoughtful, independent, and free for all readers.

If nothing else, thanks for reading.