Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

Every Sunday for the past few months, I’ve been watching my youngest play softball — eight-year-olds pitching, swinging, and sprinting with all the heart in the world. Between innings, I find myself thinking less about the score and more about the world they’ll grow up to inherit.

…2050 doesn’t feel that far away anymore.

That’s probably why I’ve been more intentional about how I stay informed — choosing signal over noise.

Each morning, I scan a few newsletters that help me make sense of where the world is heading:

The Daily Upside — concise, data-heavy stories that actually explain why the markets move, not just that they moved.

Morning Brew — the quickest way to catch signals across tech, finance, and policy before the day gets away from you.

1440 Media — a surprisingly good way to get nonpartisan headlines without the algorithmic outrage.

The world my kids will inherit depends on how well we interpret the one we’re living in and staying informed is where that work begins.

Between now and 2050, three forces are already reshaping that answer: capital, population, and affordability. Together, they will redefine where people live, how value is created, and who owns the outcome. What we are seeing is not a decline. It is a realignment that rewards foresight over scale.

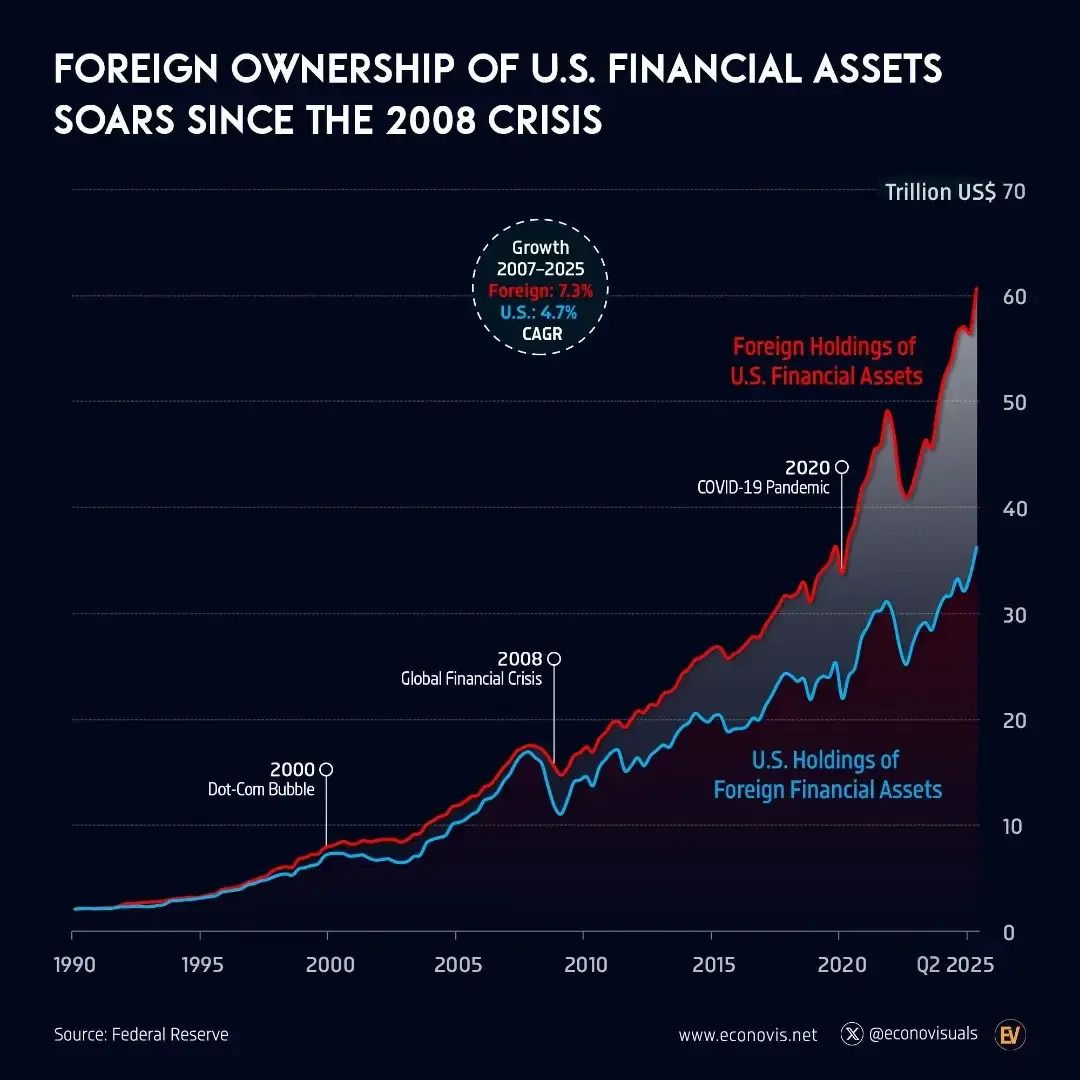

Fig. 1, Federal Reserve c/o Econovisuals

Since the 2008 Financial Crisis, the flow of global capital into the United States has accelerated. Foreign investors now hold more than $60 trillion in American financial assets, growing at 7.3% per year compared to 4.7% for U.S. investments abroad (see figure 1).

Business news as it should be.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

This is more than confidence in American markets. It is a reallocation of global trust. The United States has become the world’s preferred yield engine, a stable vessel in an unstable world. But as foreign money drives asset prices higher, domestic affordability weakens. The same forces that power markets are quietly reshaping ownership itself. Global capital is no longer a guest in American markets. It is a stakeholder.

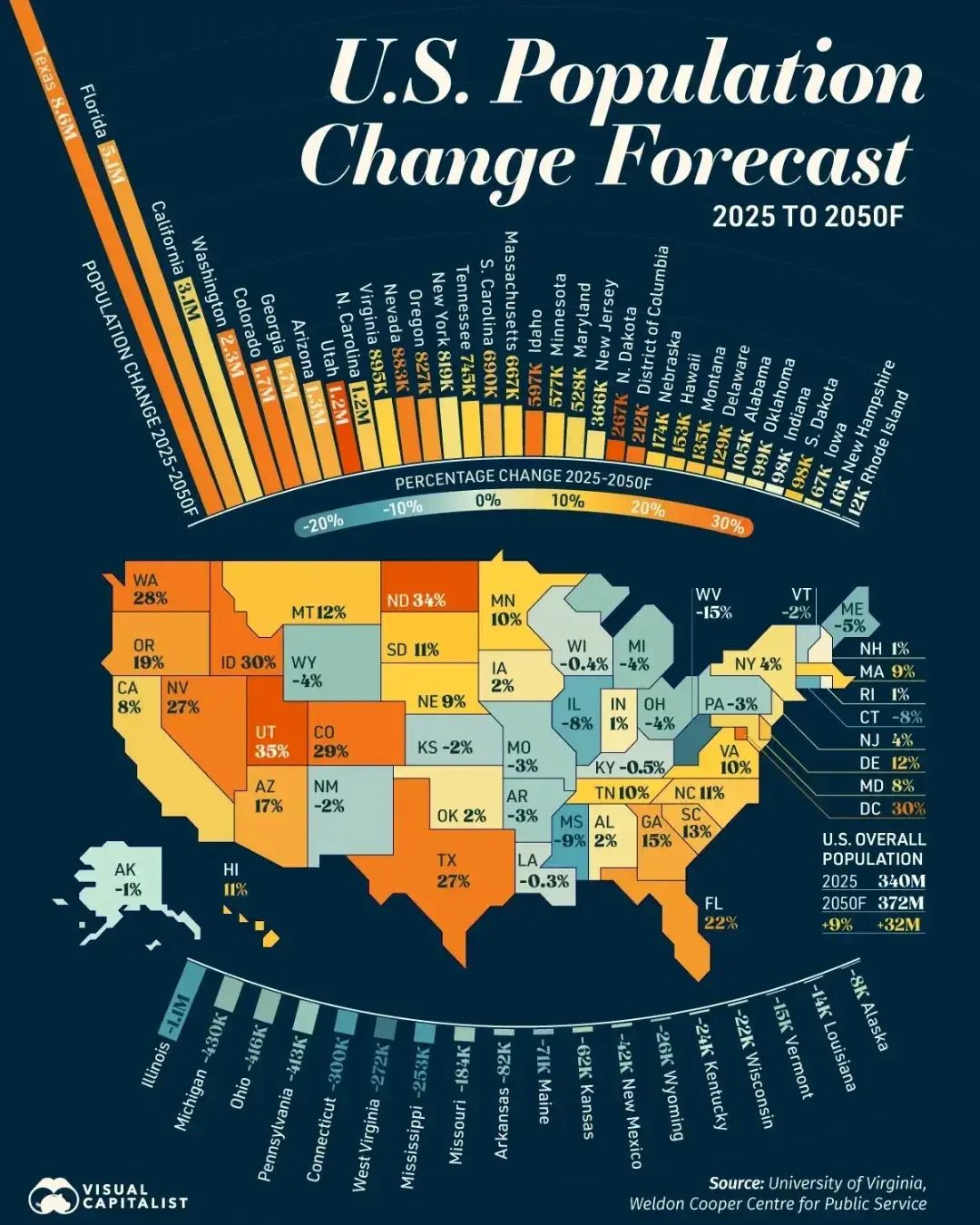

Fig. 2, University of Virginia Weldon Cooper Centre for Public Service

While capital flows in, people are moving across the country. The Sun Belt states, such as Texas, Florida, Utah, and Idaho, are becoming new centers of gravity. Between 2025 and 2050, the U.S. population will grow from 340 million to 372 million (see figure 2), but not evenly.

People are chasing space, affordability, and climate comfort. Employers are seeking talent, tax advantages, and quality of life. The result is a quiet reshuffling of power, away from the old Northeast corridor toward a diagonal corridor running from Salt Lake City through Austin to Tampa. I call it the New Productivity Belt. This is where infrastructure, innovation, and investment will compound.

Fig.3 LendingTree, c/o Visual Capitalist

Affordability is the fracture line running through it all.

The growing affordability crisis casts a long shadow over the promise of the American dream. For millions, the prospect of homeownership—once a fundamental milestone of adulthood—now feels increasingly unattainable. As wages stagnate while asset prices soar, driven in part by global investment, more young Americans find themselves locked out of markets they were promised would be theirs. The median age of first-time homebuyers is climbing, and in cities like San Jose, the share of people under 30 with a mortgage has fallen below 1% (see figure 3). Beyond just statistics, these trends represent delayed independence, diminished wealth-building potential, and mounting frustration. Communities once united by stability risk becoming fragmented by exclusion, as homeownership turns from a rite of passage into a privilege for the few. If left unaddressed, the deepening affordability gap threatens not only economic mobility but the social fabric that has long defined America's character.

The effects are uneven but deeply connected. Minority communities face widening ownership gaps that threaten long-term wealth parity. Rural regions, already strained by population loss, risk deeper economic isolation as talent and capital concentrate in growth corridors. And generational divides—between those who bought before the surge and those priced out after—are shaping not just markets but mindsets.

Policy and industry responses are beginning to take shape, though unevenly. Remember all that talk about ADUs back in 2020? That movement was an early signal, a recognition that solving affordability would require rethinking how we use space, not just how we finance it. Today, some states are revisiting zoning laws and incentivizing higher-density, transit-oriented housing. Others are piloting shared-equity models, down payment assistance programs, and tax incentives for first-time buyers.

In the private sector, innovators are testing new paths to ownership, including fractional equity platforms, employer-backed mortgage benefits, and AI-powered affordability analytics. Each of these efforts reflects a growing recognition that restoring access to housing will require coordination across public, private, and financial systems, and a willingness to keep experimenting until something truly scales.

Alas, the challenge is not in designing affordability, but in deciding who ultimately pays the price.

Where friction exists, opportunity follows. Global investors want stability. Domestic populations want affordability. Cities want growth.

The next generation of companies will live at this intersection, connecting global liquidity with local accessibility. Expect to see new models of fractional ownership, AI-assisted valuation, and community-based investing. The most important platforms of the next decade will not simply sell homes. They will rebalance ownership.

Affordability is the fracture line running through it all.

By 2050, America will not look poorer or weaker. It will look different. Capital will be more global. People will be more mobile. Ownership will be more dynamic.

This is not the end of the American dream. It is the next version of it. The Great American Realignment is already underway. The question is whether we choose to adapt to it or build for it.

xoxo,

Maximillian Diez, GP

Twenty Five Ventures

P.S. Stay with me on this journey.

If nothing else, thanks for reading.