If you weren’t paying attention, you might have missed that Compass has announced it will acquire Anywhere Real Estate in an all-stock deal valued at roughly $1.6 billion, creating a combined enterprise worth nearly $10 billion. With more than 340,000 real estate professionals worldwide, the merged entity will be the largest brokerage in the industry’s history.

This is more than just a corporate transaction. It represents a turning point, what can be called real estate’s “cap moment”. Let me explain.

Anywhere’s Assets on the Table

Compass is acquiring a potent mix of businesses and brands:

Franchise Brands: Century 21, Coldwell Banker, ERA, Better Homes & Gardens, Sotheby’s International Realty, Corcoran. Together, these reach over 18,000 offices and 300,000 independent agents worldwide.

Company-Owned Brokerage: Anywhere Advisors, with approximately 600 offices and 53,000 agents in major U.S. metros.

Title and Settlement Services: A nationwide platform operating in 43 states plus D.C..

Relocation (Cartus): A global leader in corporate and government mobility services.

Joint Ventures and Ancillaries: Mortgage partnerships, insurance, and underwriting.

Compass is poised to control more of the transaction chain, encompassing brokerage, title, insurance, relocation, and marketing.

Why This Deal Makes Sense

For Compass:

Scale: Already number one by sales volume, this merger cements its lead.

Diversification: Anywhere’s service lines expand revenue streams.

Global Reach: Compass gains a global franchise footprint.

For Anywhere:

Balance Sheet: The deal strengthens its financial foundation.

Technology Platform: Compass’ end-to-end tech stack can be deployed across Anywhere’s agent network.

Compass anticipates $225 million in cost redundancies, stronger combined free cash flow, and improved balance-sheet metrics.

A Lesson From the FCC

The FCC once set ownership caps in broadcasting, limiting the number of national or local audiences that one company could control. Over time, these caps shifted as the media landscape changed. Real estate has never had similar caps. The industry has remained fragmented, with regulation primarily at the state level, and national antitrust oversight applied as necessary.

This deal changes the picture:

Nationally: The combined Compass–Anywhere will control an estimated 16 to 18 percent of U.S. brokerage sales volume.

Locally: In major metros such as New York, Los Angeles, Miami, and Dallas, their share of active listings could reach 25 to 35 percent.

This level of concentration marks a NEW PHASE in the U.S. residential real estate market.

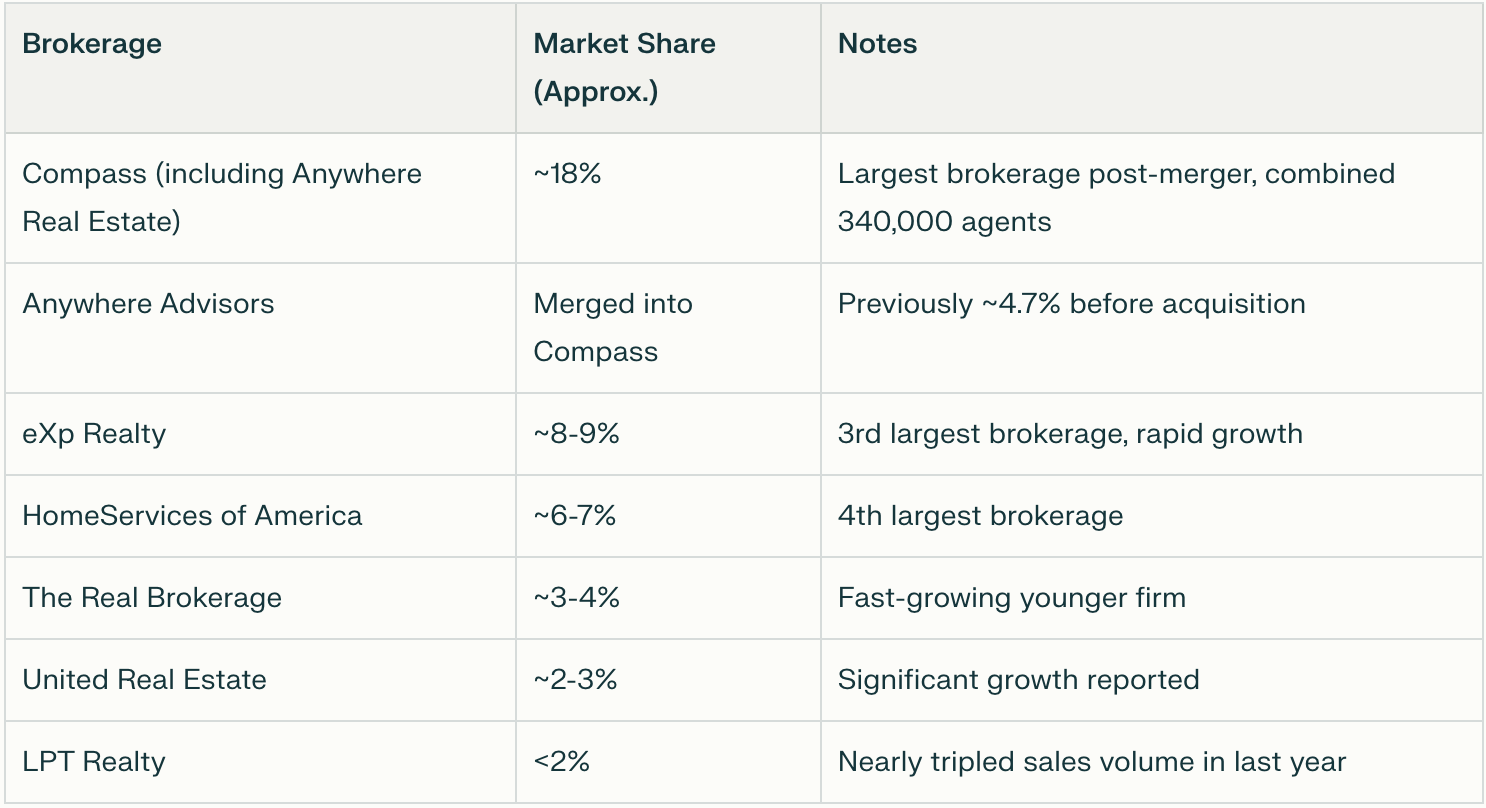

Here is the approximate nationwide market share percentage of the top US real estate brokerages in 2025 by residential sales volume and transaction sides:

According to our friends at T3 Sixty

Market Standings Show a Bifurcating Industry

Compass – $231B (+25.3%)

Anywhere Advisors – $186.7B (+6%)

eXp Realty – $152.7B (+6.3%)

HomeServices of America – $136.6B (+2.1%)

The Real Brokerage – $42.4B (+100.1%)

Douglas Elliman Realty – $36.4B (+5.8%)

Howard Hanna Real Estate – $34.5B (-0.3%)

Redfin – $29.5B (+7.2%)

Side – $24.6B (+11.8%)

Peerage Realty Partners – $24.5B (+3.4%)

The 2024 standings illustrate the shifting forces in residential brokerage.

25V

Compass surged to $231B in sales, up 25%.

Anywhere Advisors followed at $186.7B, a modest 6% increase.

eXp Realty ($152.7B, +6.3%) and HomeServices of America ($136.6B, +2.1%) grew only slightly in comparison.

The Real Brokerage was the standout, more than doubling volume to $42.4B.

Side continued steady double-digit growth, reaching $24.6B.

By contrast, traditional names such as Howard Hanna (-0.3%) and Peerage Realty Partners (+3.4%) were largely flat.

The industry is clearly splitting in two directions. At the top, mega-consolidators like Compass–Anywhere and fast-growth virtual platforms such as eXp and Real are accelerating away from the field, while legacy franchises and family-owned firms are stagnating. The combined rankings reinforce this stratification across both enterprise and franchise levels: Anywhere remains the top enterprise by volume, but Compass’s rise and its ownership of Christie’s highlight how corporate structure and franchise power can work in tandem. Keller Williams continues to anchor the franchise landscape, while Sotheby’s and Christie’s demonstrate the enduring pull of luxury brands. At the franchisee level, RE/MAX Gold Nation and Sotheby’s Majestic Realty Collective illustrate how scale and specialization can coexist. Together, these shifts reveal a market being reshaped from the top down, while opening a strategic opportunity for boutiques and SMB brokers to stand out through independence, local expertise, and consumer trust at a time when scale alone risks feeling impersonal.

What This Means for Consumers

Efficiency and Integration

The merger can streamline transactions, combining brokerage, title, escrow, and insurance under one roof.Pricing Power

With more listings and agents, Compass–Anywhere gains leverage in commission structures, marketing, and relationships with portals like Zillow and MLSes.Post-NAR Settlement Context

At a time when buyer agency commissions and consumer protections are being reevaluated, consolidation at this scale will shape outcomes for years to come.

The Compass + Anywhere merger signals a new era for large-scale brokerage platforms in U.S. real estate, bringing about competitive, regulatory, and cultural changes that are yet to unfold. Whether this results in a Big Four dominance, sparks new antitrust investigations, or speeds up technology adoption industry-wide, stakeholders should brace for rapid market shifts. Industry professionals need to reevaluate their strategies and skills, investors should watch for new opportunities and risks, and consumers are likely to see increased efficiency along with evolving market choices.

The real estate landscape has just expanded and become more complex.

xoxo,

Maximillian Diez, GP

Twenty Five Ventures

P.S. Stay with me on this journey.

If nothing else, thanks for reading.