AI Is the Market

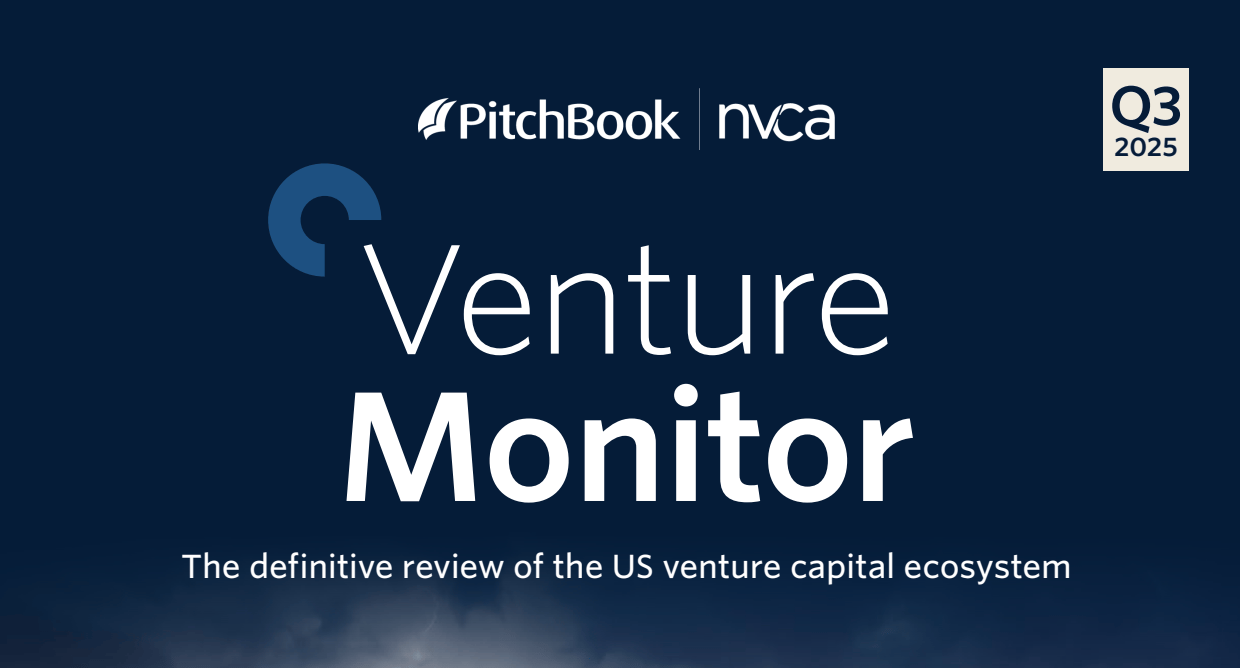

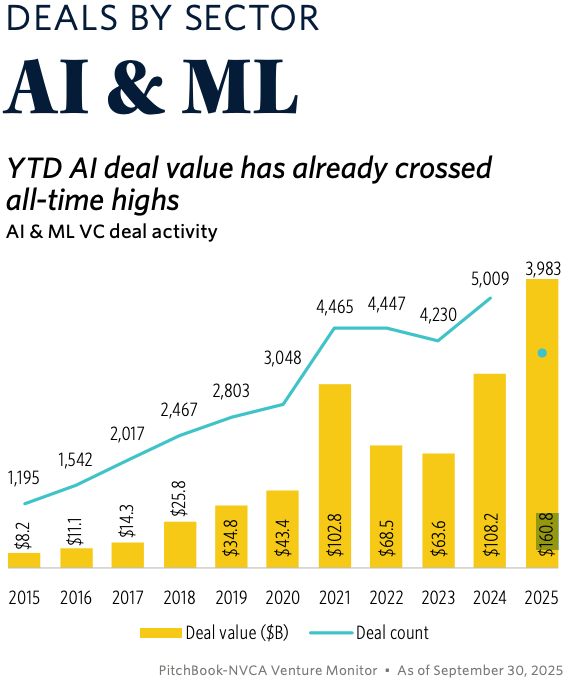

Through Q3, AI companies captured 64.3% of all venture deal value. That’s more than double their share of deal count. Ten companies alone took 41% of all VC dollars. This year, AI deal volume hit $160.8 billion, smashing 2024’s record of $108.2 billion.

Here’s what that looks like:

Anthropic raised $13 billion at a $183 billion valuation.

Databricks closed $1 billion at $100 billion.

xAI raised $10 billion at $75 billion.

Average AI round: $58.9 million. That’s nearly twice the rest of the market.

If you’re not building with an AI edge, you’re going to be asked why.

Fundraising Is Brutal Everywhere Else

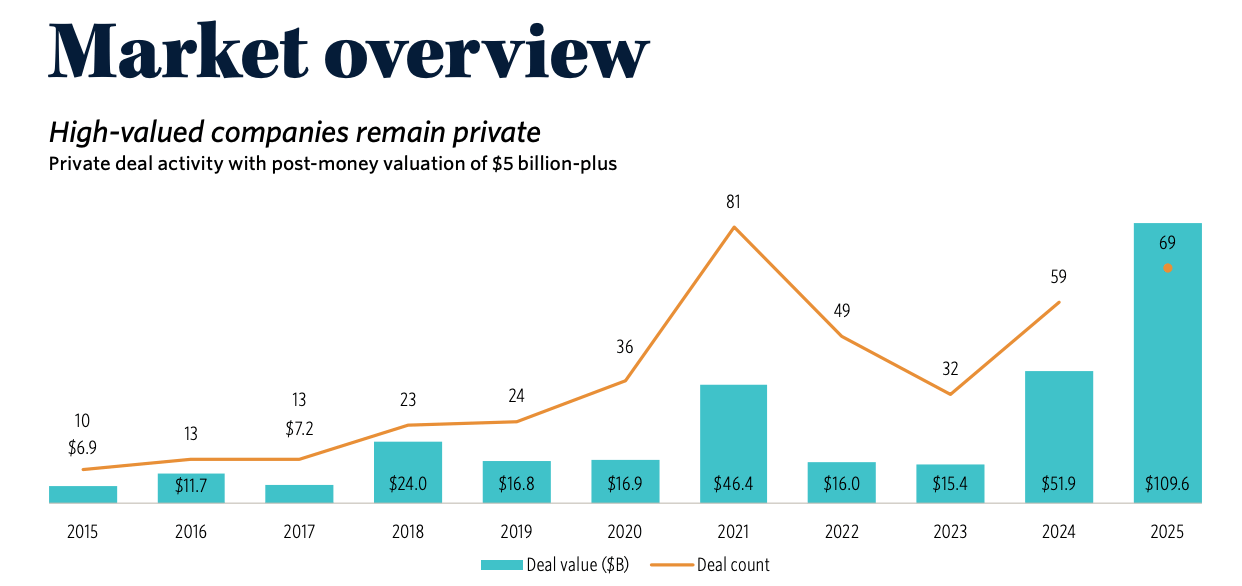

LPs are dry. The money raised through Q3 is just $45.7 billion, pacing for the worst year since 2017. The time to close a fund is now 15.6 months, up from under 10 in 2022. Seventy percent of funds raised in 2021 or 2022 haven’t closed a follow-on.

That pain hits founders, too. Here’s what you’re up against:

Multi-stage firms are going earlier, crowding out emerging managers.

Pricing power has shifted hard to investors.

LPs are contributing more than they’re receiving, and they’re pulling back.

Founders raising now are caught in this squeeze. You’re asking VCs for checks while they’re struggling to raise their own.

IPOs Are Back, Selectively

September saw the most IPO activity since 2021. But exits remain lopsided. Tech accounts for 95% of IPO value. Only eight biotech and pharma firms went public this year, compared to 22 last year.

Some recent debuts:

Figma saw a 250% pop, fueled by profitability and AI features.

Firefly Aerospace listed at $5.6 billion, double its last round.

Gemini hit $7.1 billion on news of the GENIUS Act.

But many of these are now trading below IPO pricing. First-day pops are no guarantee of long-term valuation.

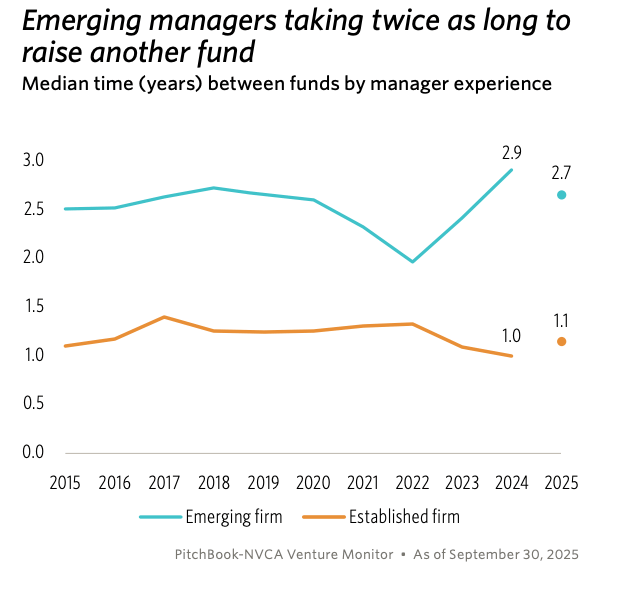

Emerging Managers Are Getting Crushed

Only 177 emerging manager funds have closed in 2025, a ten-year low. Fewer than 21% of first-time managers from 2021-2022 raised a second fund. The bar has moved. Past performance isn’t enough. LPs want DPI. They want returns.

Big platforms—Andreessen, General Catalyst, Sequoia—are showing up earlier. They’re crowding the seed stage. If you’re working with an emerging manager now, their ability to lead or follow is limited.

Policy Matters Now

The OBBBA (One Big Beautiful Bill Act) was passed in July, giving some tailwinds:

QSBS exclusions expanded: $15M or 10x basis, with more favorable holding periods.

R&D expensing revived and made permanent.

100% bonus depreciation restored for assets acquired after January 19, 2025.

Still, energy tax credits are being phased out, and AI-related tax proposals are now on the table.

Founders: What You Should Be Doing Right Now

You’re not going to wait out this market. You have to build and raise inside it.

Here’s what works:

Have an AI story. Even if you’re not building an LLM, show how AI helps you scale, price, or win.

Push to profitability. VCs want efficient growth. The old “blitz and bleed” model is dead.

Know your path to liquidity. Whether through acquisition or IPO, you need a plausible exit narrative.

Choose your investors carefully. Some managers can’t follow on. Others won’t survive next year.

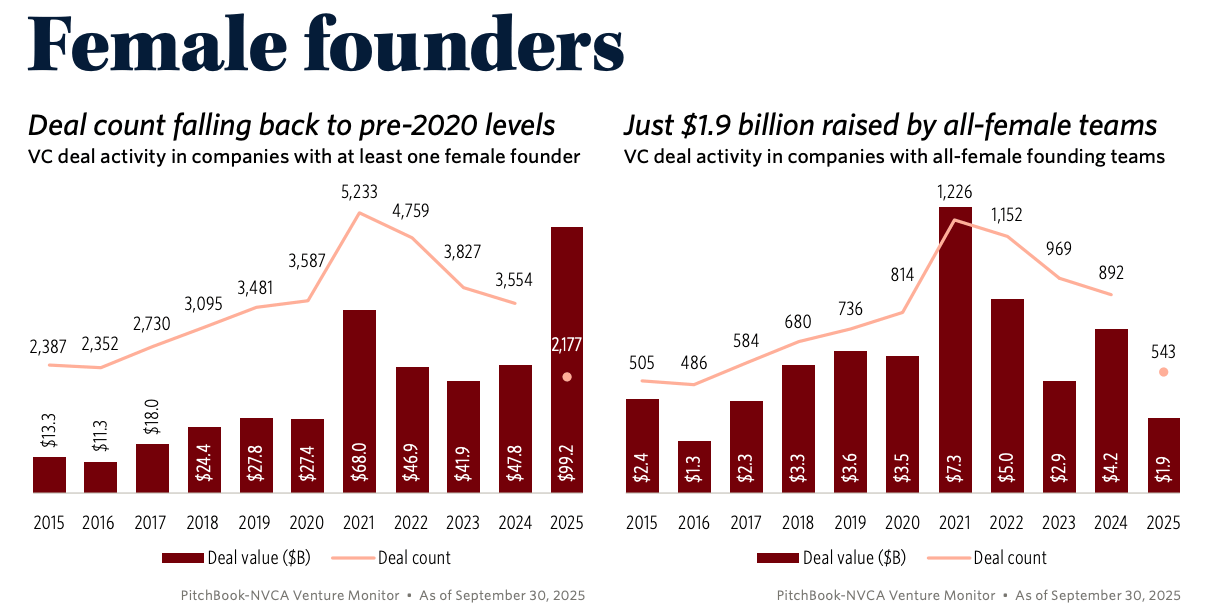

If you’re from a historically underfunded background, it’s even harder. But adversity can be a moat. I’ve bet on founders who fought harder to get to the starting line. I look for grit and hunger, not polish.

In 1999, I walked away from a stable job to finish college. I started an investment firm at 21 with nothing but a license and a mentor. No one handed me capital. I earned it one client at a time. Nothing worth anything is ever easy.

The Market Is Split. You Have to Know Where You Stand.

This is the most unequal market we’ve seen since the Great Financial Crisis. Founders building in AI, defense, and energy are on a rocket. The rest are grinding.

But cycles turn. Liquidity will come back. Until then:

Be relentless about efficiency.

Treat capital like it’s your last check.

Backers matter. Take the meeting with the emerging manager. They remember who bet early.

Key Stats

AI accounts for 64.3% of venture deal value.

Total fundraising through Q3: $45.7B, lowest since 2017.

Median time to close a fund: 15.6 months.

Only 20.4% of 2021-2022 first-time managers raised follow-on funds.

If you're raising now, tighten the story. Show survival. Show scale. And remember, every round you close now is a win in the hardest venture market in a decade.

xoxo,

Maximillian Diez, GP

Twenty Five Ventures

P.S. Stay with me on this journey.

If nothing else, thanks for reading.