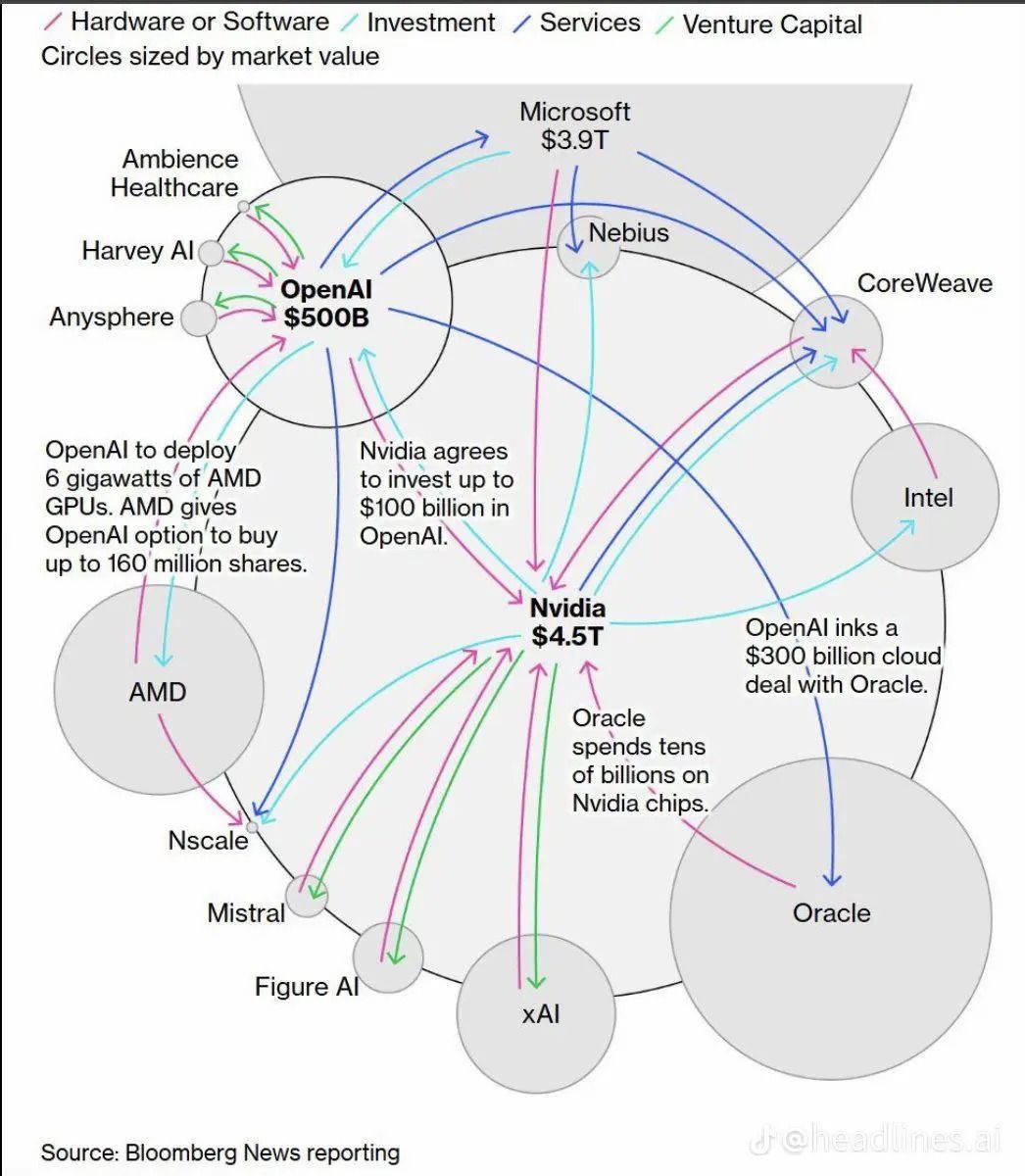

What began as a competition to build smarter models has turned into a perfect economic loop. AI companies purchase compute resources from their investors, who then reinvest in the chips that power the next round of growth.

The Meaning Behind the Symbol

An ouroboros is an ancient symbol of a serpent eating its own tail. It represents a cycle that continually consumes and renews itself. In mythology, it symbolized eternity. In technology, it now describes something far more modern: a self-sustaining system where money, chips, and compute flow endlessly in circles.

This is the AI ouroboros, a trillion-dollar feedback loop built by the world’s largest technology companies. It is how Big Tech funds, powers, and profits from the same systems that depend on them.

Bloomberg c/o Headlines.ai

Microsoft: The Catalyst

The loop begins with Microsoft. It invested $13 billion in OpenAI, becoming both its largest investor and its host. Every time someone uses ChatGPT, powered by GPT-5, the computation runs on Azure, Microsoft’s cloud platform.

The success of OpenAI drives Azure usage, which increases demand for NVIDIA GPUs. Microsoft buys those chips to power its servers, completing the first circle of capital, compute, and control.

Amazon and Google: The Rivals Inside the Loop

Amazon and Google joined the same cycle. Amazon invested $4 billion in Anthropic, while Google put in $3 billion. Both now host Anthropic’s models on their own clouds, AWS and Google Cloud.

Their strategy mirrors Microsoft’s approach. Each invests in a leading AI lab, makes that company a major cloud customer, and captures recurring revenue from compute. It is both venture capital and vertical integration. The investment itself becomes customer acquisition.

NVIDIA: The Engine That Everyone Feeds

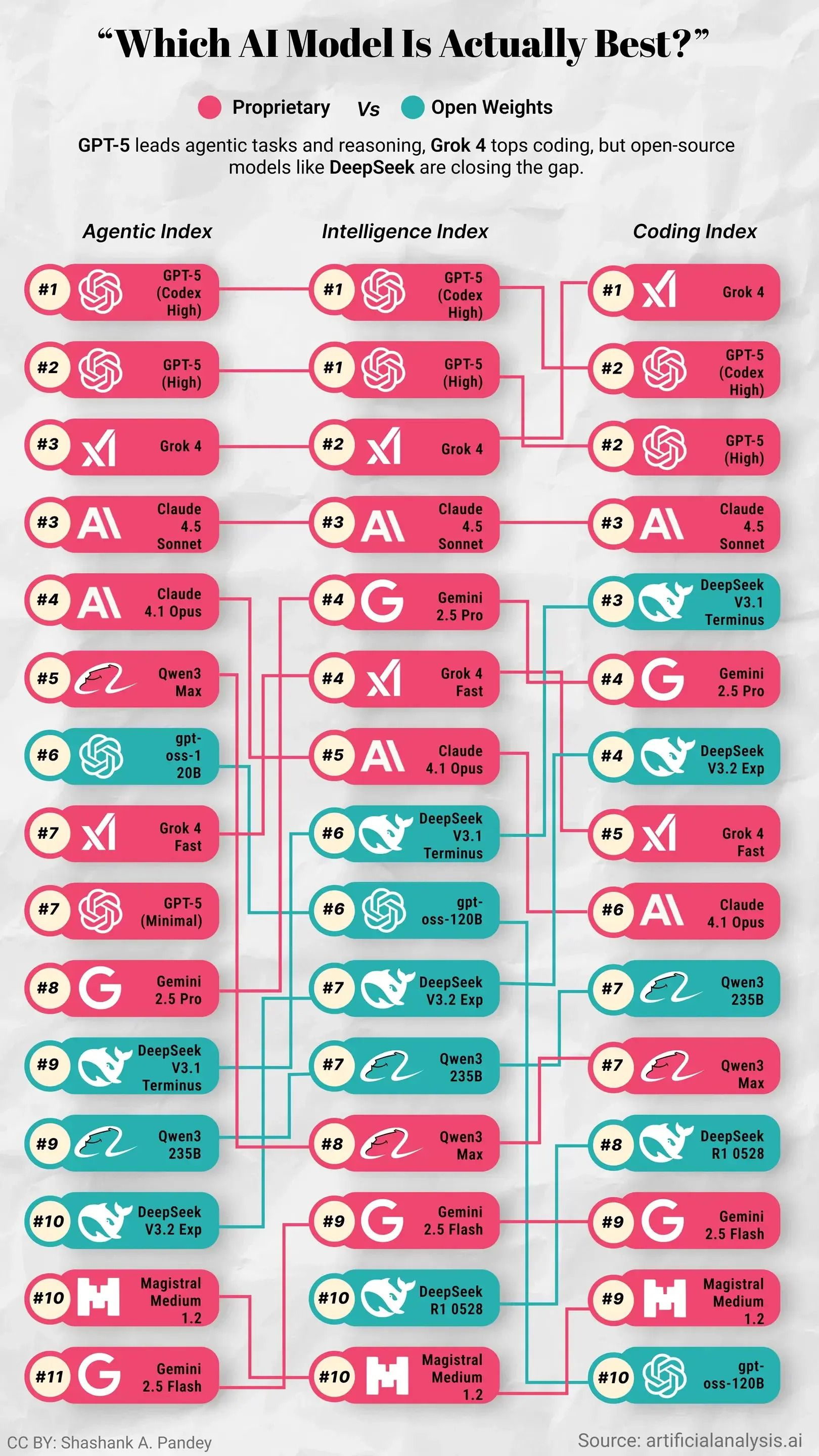

At the center sits NVIDIA, the quiet winner of this new economy. Every major AI model, from GPT-5 to Claude and Gemini, runs on NVIDIA chips.

NVIDIA’s GPUs have become the currency of intelligence. Microsoft, Amazon, Google, Meta, and Oracle all compete to secure their supply chains. NVIDIA, in turn, invests in CoreWeave, a GPU cloud provider, and partners with Intel and Oracle to expand access. The company sells to everyone and stands above the rivalry.

Intel, the Government, and the Chip Sovereignty Push

Intel is working to rebuild its relevance through the CHIPS Act, which channels billions in federal funding to restore domestic semiconductor manufacturing. The U.S. government now holds a partial stake in Intel’s resurgence, viewing chips as a matter of national security.

This public investment links the state to the same industrial loop. The ouroboros is no longer just corporate; it is geopolitical.

Meta, Oracle, and AMD: The Supporting Cast

Meta powers its open-source LLaMA models with thousands of NVIDIA GPUs.

Oracle has built GPU-heavy cloud clusters in partnership with NVIDIA.

AMD provides an alternative chip line, capturing overflow demand when NVIDIA’s supply runs short.

All three reinforce the same dependency chain.

The Self-Feeding Cycle

When you trace the flow of money, the pattern becomes clear:

Big Tech invests in AI model companies such as OpenAI and Anthropic.

Those startups run their systems on the investor’s cloud infrastructure.

NVIDIA reinvests in infrastructure to expand production.

Governments subsidize new fabs and supply chains to sustain it all.

Each transaction fuels the next. The AI industry is not only growing; it is compounding.

Why It Matters

This loop explains why AI feels unstoppable. The growth is not linear. It is circular and accelerating. When Microsoft funds OpenAI, it is also funding Azure’s expansion, NVIDIA’s earnings, and the energy infrastructure required to power the next generation of data centers.

AI’s growth is not driven by one company or one idea. It is driven by a system that continuously feeds itself.

When We Last Saw This Kind of Ecosystem

Today’s AI ouroboros is not entirely new. History shows three earlier cycles where technology, capital, and dependency aligned in similar ways.

1. The Wintel Era (1990s–2000s)

Microsoft and Intel created the first ouroboros of personal computing. Windows required Intel chips, and Intel’s processors were optimized for Windows. PC makers like Dell and HP built around that loop. Software drove hardware upgrades, hardware sales funded software innovation, and both companies dominated for two decades.

2. The Cloud and Internet Stack (2000s–2010s)

As the web scaled, Amazon, Google, and Microsoft built the backbone of modern computing. Startups that relied on their clouds produced data that increased demand for more servers and storage. Advertising and SaaS revenue funded new infrastructure, and the loop tightened around the same three players.

3. The Mobile Platform Economy (2010s)

Apple and Google repeated the pattern through iOS and Android. Developers built apps for their stores. Each transaction generated platform fees that funded new devices and chips from TSMC and Qualcomm. More apps created more device demand, and the cycle repeated globally for a decade.

The AI ouroboros is the fourth phase of this progression, but this time the stakes include national policy, semiconductor supply, and energy grids.

The Pressure Points

The ouroboros will face limits.

Chip scarcity will continue as demand outpaces fabrication capacity.

Energy constraints will test how fast data centers can expand.

Regulatory pressure will question whether these circular partnerships concentrate too much power.

However, no player can afford to step out. Each is tied to the same feedback loop, and breaking it would mean slowing its own growth.

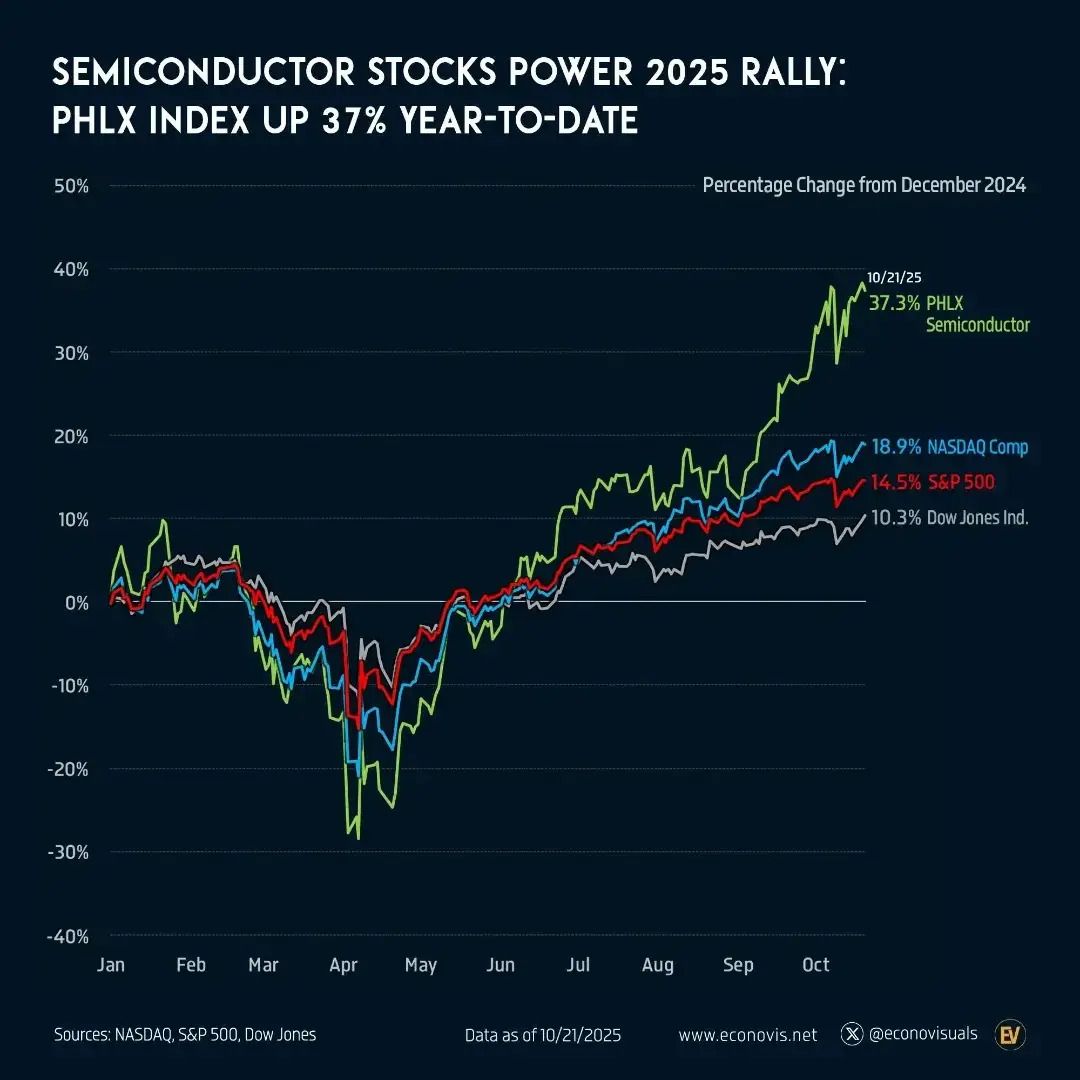

Where the Investment Flows Next

While Twenty Five Ventures does not invest in public equities, it is clear that capital markets are signaling where future value may accrue. Upstream players such as NVIDIA, TSMC, and ASML remain foundational, yet the most explosive growth is shifting downstream toward the applications and verticals that convert AI into tangible business value.

In this new phase, companies building AI-driven solutions for real estate, lending, logistics, and healthcare are poised to capture disproportionate returns. These firms sit closest to the customer and transform raw compute power into operational advantage.

For investors focused on private markets, this is where the opportunity lies. The next generation of category leaders will emerge not from chip fabrication or model training, but from practical deployment, where AI reshapes workflows, decision-making, and profitability.

In the same way that Salesforce and Shopify rose from the cloud era, and Instagram and Uber defined mobile, today’s downstream recipients of AI innovation will define the next decade of enterprise value creation.

The Bigger Picture

AI is no longer a product race. It is an infrastructure race built on chips, capital, and cloud dominance. Whoever manages the most efficient loop—from silicon to software to service—will define the next decade of technology.

For now, that loop begins and ends with four names: Microsoft, Amazon, Google, and NVIDIA.

But its long-term beneficiaries may be the builders who turn that loop outward, applying intelligence where it touches the real economy.

Writing about the ouroboros always reminds me that progress rarely happens in straight lines. Each generation of technology builds on the last, but the pattern stays the same: a few companies create the infrastructure, and a new wave of founders figures out how to use it better.

At Twenty Five Ventures, our work is grounded in those moments — when access to new infrastructure suddenly reshapes what is possible. From AI in PropTech to new tools for financial inclusion, we look for founders who see how these loops can be redirected toward real human outcomes.

That is what it means to look through the VC looking glass: to study the pattern, anticipate the next curve, and invest where intelligence meets impact.

My take, every ouroboros ends the same way — the serpent eventually runs out of tail.

xoxo,

Maximillian Diez, GP, Twenty Five Ventures

P.S. Stay with me on this journey.

If nothing else, thanks for reading.