In Part I, we framed the Compass and Anywhere merger as real estate’s “cap moment,” the clearest sign yet of industry concentration. The next step is to understand how this will impact branding, franchising, and the independent broker landscape. The outcome will not only shape Compass and Anywhere’s future, but it will also define the kinds of firms consumers and agents trust in the decade ahead.

How a $25M Catalyst Could Bring Robotics Nationwide

Automation’s the future, but 71% of execs say upfront costs prevent its adoption. That’s why Miso Robotics’ new $25M hardware financing facility for customers turned heads. Miso’s AI-powered kitchen robots have logged 200k+ hours for brands like White Castle. With this $25M line and partnerships with NVIDIA, Amazon, it’s unlocking quick, flexible adoption of cutting-edge automation. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

Already, agents are whispering in group chats: Will Coldwell Banker survive under Compass? Will decades of brand equity disappear? For consumers, the question is different but just as real: what happens when there are fewer brands to choose from in a market where trust already feels scarce?

Compass’ Playbook: One Brand to Rule Them All

Compass has consistently scaled by acquiring regional brokerages and rebranding them under its own name. Pacific Union International, Alain Pinel Realtors, and Stribling & Associates all disappeared into the Compass identity. The rationale was straightforward: a single brand fosters national recognition, streamlines recruitment, and enhances technology positioning.

Anywhere presents a different challenge. Its portfolio holds some of the most iconic names in real estate: Century 21, Coldwell Banker, Sotheby’s International Realty, ERA, Better Homes & Gardens, and Corcoran. These brands carry consumer trust built over decades and complex contractual obligations with thousands of franchisees.

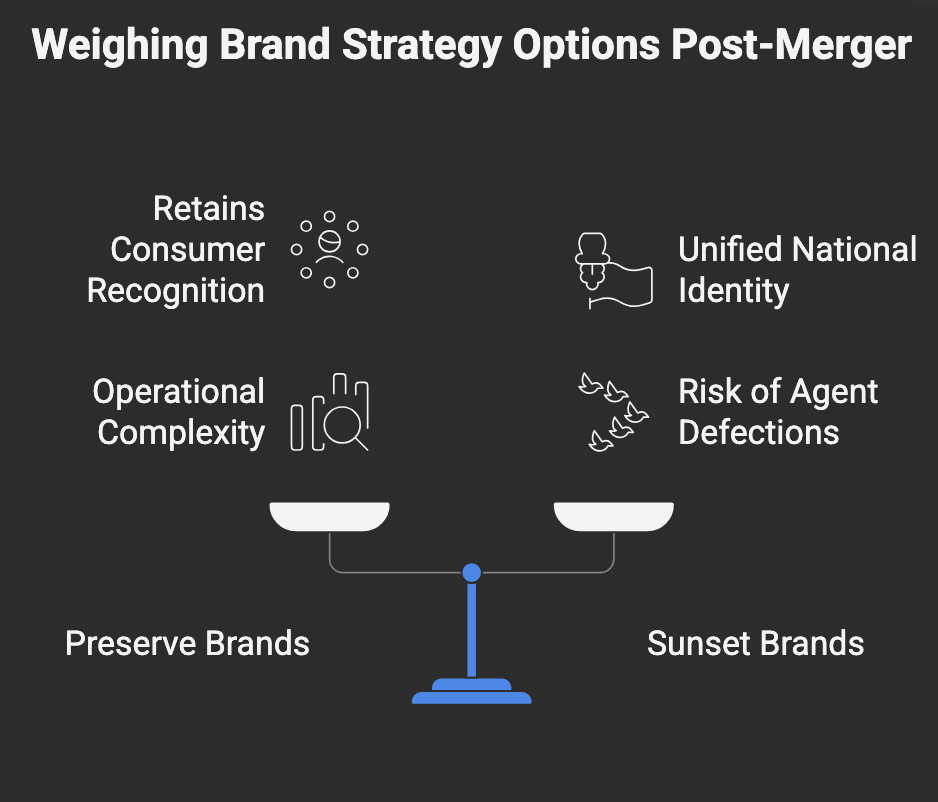

Publicly, Compass has signaled that these brands will remain. But the company’s history suggests the gravitational pull of consolidation will resurface. The decision to either maintain or sunset Anywhere’s brands will be one of the defining tests of the merger.

The Cendant Precedent: Growth, Scandal, and Breakup

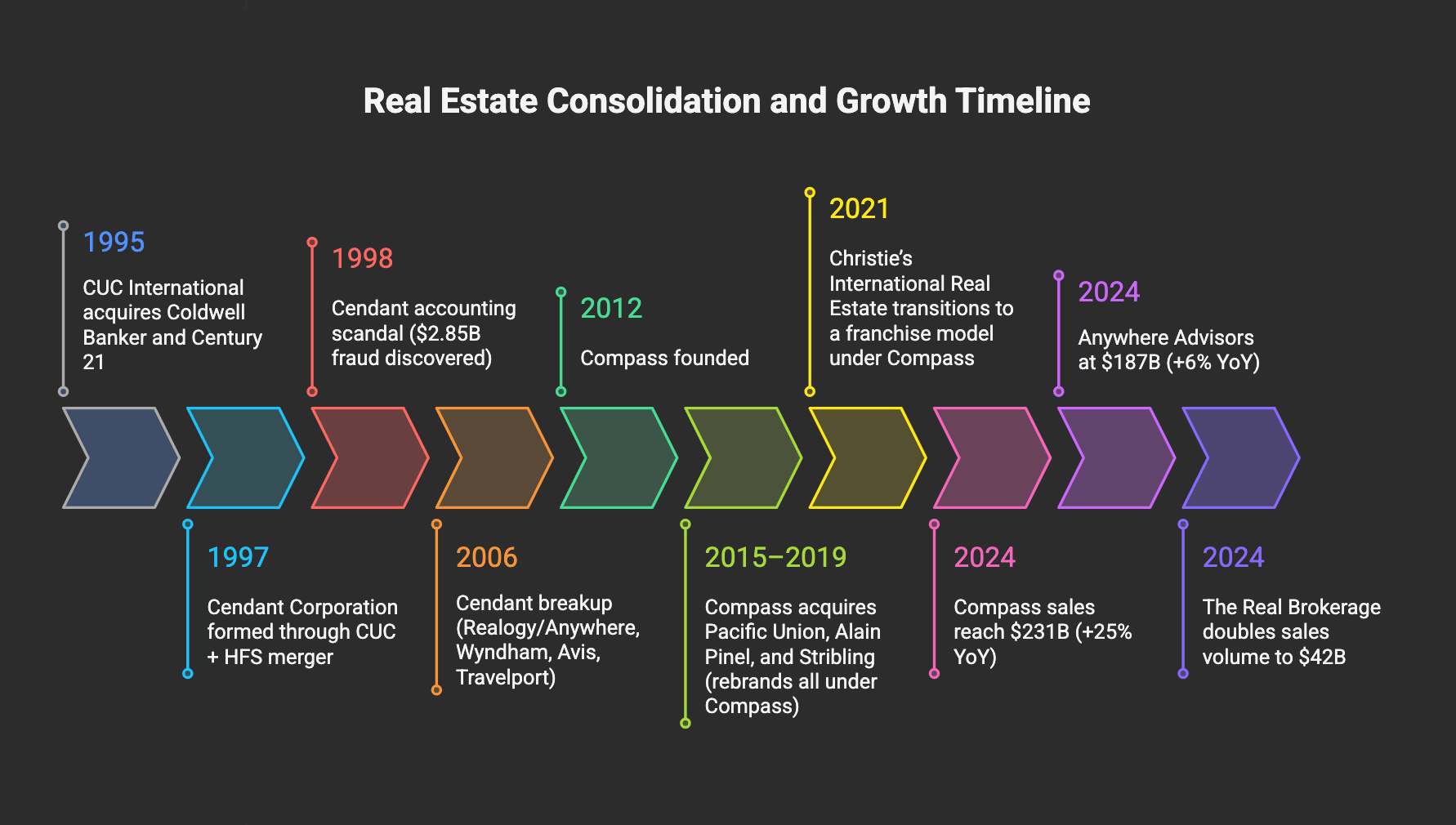

This is not the first time real estate has witnessed sweeping consolidation. In the 1990s, Cendant Corporation assembled a sprawling portfolio spanning hotels, travel, car rentals, and real estate. Century 21 and Coldwell Banker were part of its empire.

The model collapsed after a massive accounting scandal involving its merger partner CUC International. By the mid-2000s, Cendant was forced to break itself apart. Realogy (later rebranded as Anywhere) became the home of its real estate holdings, while Wyndham, Avis, and Travelport were spun out separately.

History Lesson: The Rise and Fall of Cendant

1990s Expansion: Cendant grew into a service giant with holdings in hotels, travel, car rentals, and real estate franchising. Its portfolio included Century 21 and Coldwell Banker.

1998 Scandal: A merger with CUC International exposed massive accounting fraud. Revenues had been overstated by hundreds of millions of dollars. Investor trust collapsed.

2005–2006 Breakup: Cendant split into four separate companies:

Realogy (now Anywhere) – real estate franchising

Wyndham Worldwide – hotels and timeshares

Avis Budget Group – car rentals

Travelport – travel distribution technology

Takeaway: Consolidation can create power, but also complexity and fragility. When trust erodes, fragmentation follows.

25V Research

Market Standings and Stratification

The 2024 brokerage standings (See Part I)underscore the diverging forces in the industry:

Compass surged to $231B in sales (+25.3%).

Anywhere Advisors followed at $186.7B (+6%).

eXp Realty ($152.7B, +6.3%) and HomeServices of America ($136.6B, +2.1%) posted modest growth.

The Real Brokerage doubled to $42.4B (+100%).

Side expanded steadily, reaching $24.6B.

Legacy players such as Howard Hanna (-0.3%) and Peerage Realty Partners (+3.4%) were stagnant.

On the enterprise side, Anywhere remains No. 1, leveraging its brokerage and franchise platforms. Keller Williams holds No. 2, HomeServices of America No. 3, and Compass now climbs to No. 4. Enterprises in the top 20 grew 11.5% year-over-year, nearly three times the national market.

In the franchise rankings, Keller Williams remains the largest U.S. franchise. Sotheby’s posted the strongest year-over-year growth among major franchises. At the same time, Christie’s International Real Estate entered the top 10 after shifting to a formal franchise model in 2021 with support from its new parent, Compass. On the franchisee side, RE/MAX Gold Nation remains No. 1, while Sotheby’s-affiliated Majestic Realty Collective holds No. 2.

Market Bifurcation: Three Tracks Emerging

Mega-Consolidators: Compass and Anywhere dominate with scale and vertical integration.

Virtual Platforms: eXp and Real grow rapidly with agent-first, tech-enabled models.

Stagnating Legacy Players: traditional franchises and family firms struggle to keep pace.

Opportunity Layer: SMBs and boutique brokerages can leverage independence, trust, and local identity as the giants integrate.

When giants consolidate, independents grow.

The Boutique Counter-Trend

Every wave of consolidation has sparked a counter-trend of independence. In the 2000s and 2010s, boutiques like CORE, The Agency, Douglas Elliman, and Hilton & Hyland thrived on high-touch, hyper-local service. Technology has leveled the playing field, allowing small firms to market effectively without a national reach.

Compass itself began with a boutique aesthetic before expanding to a national scale. Now, as it consolidates Anywhere, the cycle may start again. Group texts and private calls among agents already suggest an appetite for differentiation, with a focus on independence, local identity, and consumer trust, while giants focus on absorbing each other.

What Happens Next

Two possible paths lie ahead:

Preserve the brands. Compass inherits operational complexity, juggling multiple legacy systems and franchise contracts.

Sunset the brands. Compass risks alienating agents and franchisees, potentially encouraging them to defect to smaller businesses and boutique firms.

25V Research

Neither outcome is risk-free. Both create openings for smaller players to present themselves as stable, locally trusted alternatives.

Bottom Line

The Compass and Anywhere merger is the most significant consolidation event in the modern real estate industry. Yet history shows mergers rarely settle the market in one direction. The breakup of Cendant, Compass’ history of rebranding acquisitions, and the continued resilience of boutique firms all point to a recurring truth. When large players combine, smaller independent companies often find new opportunities to grow.

For Compass, the challenge is to prove that scale, technology, and vertical integration can deliver lasting advantage and anchor the center of the market. For SMB brokers, the opening is just as clear. By leveraging local expertise, independence, and consumer trust, smaller firms can capture more influence than ever, while the most prominent brands remain focused on integration.

xoxo,

Maximillian Diez, GP

Twenty Five Ventures

P.S. Stay with me on this journey.

If nothing else, thanks for reading.