📰 Key Highlights

Homeowners Face a Sell or Stay Dilemma: Many hesitate to sell and give up low mortgage rates, fearing higher payments.

PE Firms and Unsold Assets: PE firms struggle with unsold portfolio companies, pressuring limited partners (LPs) who rely on returns.

Mortgage Rates & Market Sentiment: Sentiment and interest rates will drive liquidity, and M&A activity will be pivotal for unlocking capital.

🚀 Homeowners' Dilemma: Sell or Stay?

We recently met with Eddie Le, co-founder of Gravity Advisors and an investment banker based in San Diego, at Mints and Honey, a VC hub in Burlingame. Over coffee, we discussed the pressing liquidity issues homeowners and private equity firms face as 2025 approaches. Eddie’s insights on market dynamics inspired me to dive deeper into how rising interest rates and hesitant buyers challenge both sectors to find creative solutions. The conversation focused on strategies for maintaining liquidity in this evolving market. We both pointed out that “the housing market is stuck in a push-pull dynamic—where sellers are waiting for better conditions, but buyers are even more hesitant to make a move.”

Homeowners are in a bind: they can sell their homes for substantial liquidity, but the decision comes with significant trade-offs. Today’s median home price has surged, but the inventory remains low, limiting where sellers can go next. Compounding the problem is the "interest rate lock-in effect." Many homeowners locked in historically low mortgage rates, often below 4% during the pandemic. If they sell, they'll be forced to secure a 6-7% mortgage, resulting in significantly higher monthly payments—even if they purchase a home of similar value.

For example, a homeowner who secured a 3% mortgage on a $400,000 home might be reluctant to sell, as buying a similar home with a new 7% mortgage would cost hundreds more each month. This has led to stagnation in the housing market, as people opt to stay in their homes, waiting for rates to drop before considering a move.

Critical Considerations for Homeowners:

High mortgage rates limit options for buyers and discourage potential sellers.

Reduced housing inventory makes it hard to find new properties, even if liquidity is gained through selling.

Homeowners must weigh short-term liquidity against long-term financial comfort.

The Liquidity Quandary: Homeowners and Private Equity in 2025

Introductory Sentence/Hook:

As we approach 2025, homeowners and private equity (PE) firms are grappling with a similar problem: liquidity. High interest rates and inflated asset prices have left both groups at a crossroads.

Private Equity’s Liquidity Challenges: Selling Amid a Standoff

PE firms face similar hurdles but on a larger scale. Despite having tons of dry powder, deal flow has slowed as fewer attractive opportunities exist. Eddie noted, “The big PE shops have tons of money to deploy in current funds, but the lack of deals in the market is a real challenge. The flight to quality has reduced the number of potential opportunities, leaving GPs with a much smaller universe of attractive investments.”

Homeowners' Dilemma: Sell or Stay?

The lack of liquidity is particularly problematic because many LPs—such as pension funds—are cash-flow sensitive. Unlike homeowners, who can often afford to wait, LPs in large funds may demand liquidity sooner, forcing GPs to explore alternative solutions.

Eddie and I both agreed that there’s currently a flight to quality in the market. 🤩

" Quality" is defined by a combination of growth, capital efficiency, strong leadership, and solid fundamentals. This heightened focus on quality has shrunk the universe of potential deals as homeowners and PE firms navigate liquidity challenges amid rising interest rates.

PE Liquidity Options Include:

Secondaries Market: Selling stakes in portfolio companies to another buyer, though typically at a discount.

Recapitalizations: Restructuring debt and equity to release cash while maintaining ownership.

Continuation Funds: Rolling over assets into new investment vehicles, allowing LPs to cash out or reinvest.

Dividend Recapitalizations: Issuing debt to the company to fund dividends for LPs without requiring a full sale.

While these strategies can provide short-term liquidity, their long-term viability depends on improving market conditions. A rebound in deal-making and lower borrowing costs would allow for more traditional exits, easing the pressure on GPs and LPs alike.

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

The big PE shops have tons of money to deploy in current funds, but the lack of deals in the market is a real challenge. The flight to quality has reduced the number of potential opportunities, leaving GPs with a much smaller universe of attractive investments

-Eddie Le, co-founder of Gravity Advisors

Market Sentiment and Interest Rates in 2025: The Path Forward

The path to liquidity in 2025 for homeowners and private equity will heavily depend on sentiment shifts and interest rates. As the Federal Reserve manages inflation, any rate cuts could bring buyers back into the market—whether they are purchasing homes or private equity assets. However, if rates remain elevated, we could see prolonged caution, with buyers unwilling to pay premiums or take on high borrowing costs.

If Rates Decrease:

In real estate, lower mortgage rates could boost affordability, attracting more buyers and freeing up inventory.

In PE, reduced borrowing costs would stimulate deal activity, making exits more viable and increasing liquidity for LPs.

If Rates Stay High:

We may continue to see a sluggish real estate market, with homeowners holding onto their low-rate mortgages.

In PE, GPs may be forced to pursue more alternative liquidity solutions like secondaries or recaps to return capital to their LPs.

Takeaway:

Whether you're a homeowner looking to sell or a PE firm managing portfolio exits, monitoring market trends closely is crucial. Consider creative solutions to unlock liquidity in the interim and prepare to act when conditions shift.

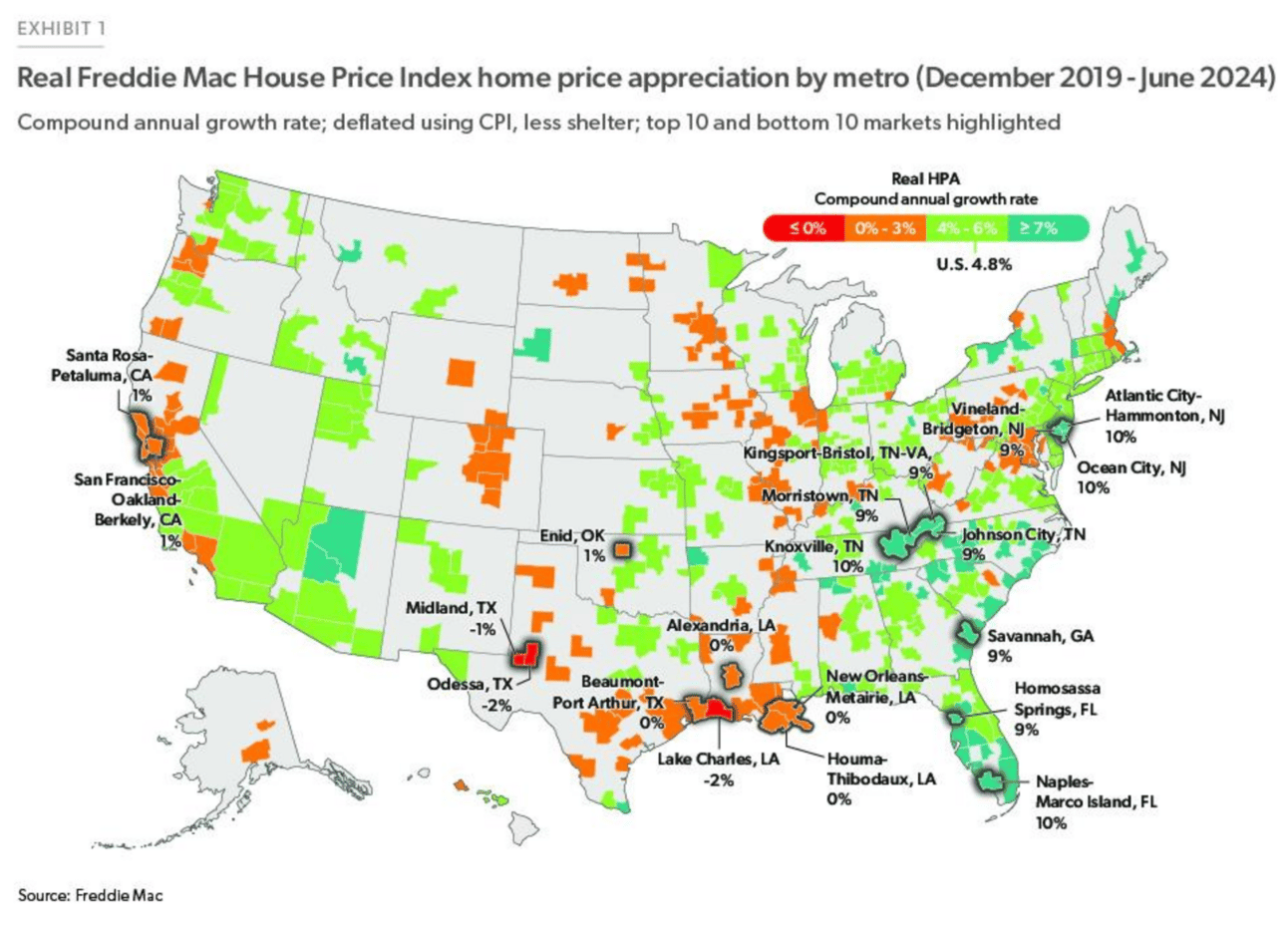

📊 Quick Stats/Charts

Median Home Price (2024): $394,300—up 3.9% from last year.

Private Equity Dry Powder (2024): $3.2 trillion in unsold assets.

Projected 30-Year Fixed Mortgage Rate (2025): 6.4%, slightly lower than 2024’s average of 6.8%.

🌐 Links & Resources

💬 Final Thoughts

Both homeowners and private equity firms face the same issue: liquidity is hard to come by in today’s environment. While there are creative solutions, 2025 will likely be defined by how interest rates evolve. Will you be ready to make the move when the time is right? Homeowners and Founders alike.

xoxo,

Maximillian Diez

Gif by friends on Giphy

LinkedIn: 25V on LinkedIn

Website: Twenty Five Ventures

P.S. Stay with me on this journey.

If nothing else, thanks for reading.