In January of 2018, I wrote an article that outlined blockchain's potential to revolutionize real estate by addressing slow transactions, title fraud, and excessive intermediaries, concepts that now align with institutional moves like BlackRock's tokenization efforts and New Jersey's land records project.

What 100K+ Engineers Read to Stay Ahead

Your GitHub stars won't save you if you're behind on tech trends.

That's why over 100K engineers read The Code to spot what's coming next.

Get curated tech news, tools, and insights twice a week

Learn about emerging trends you can leverage at work in just 10 mins

Become the engineer who always knows what's next

From REITs to Real-World Assets

Traditional real estate access relied on REITs, private funds, and mortgage-backed securities with high minimums, delayed settlements, and multiple intermediaries. Tokenization shifts this by creating programmable shares on blockchain, automating compliance and enabling 24/7 transfers. BlackRock launched its USD Institutional Digital Liquidity Fund (BUIDL) on Ethereum via Securitize in 2024 as a template for real estate and other assets, with Larry Fink calling it the start of tokenizing all assets, including property.

BlackRock’s Playbook

BlackRock upgrades its capital markets layer, porting existing real estate strategies, managing tens of billions in AUM onto faster, fractionalized rails without targeting individual homes. BUIDL demonstrates institutional grade on-chain transferability, positioning tokenization as a multi-trillion-dollar market where real estate leads due to its illiquidity and scale. Blackrock also backed Securitize to go public via SPAC Securitize has tokenized billions of dollars of assets, including BUIDL. Analysts project tokenized real estate growing from under $0.3 trillion in 2024 to $4 trillion by 2035 at a 27% CAGR, driven by funds, loans, and securitizations.

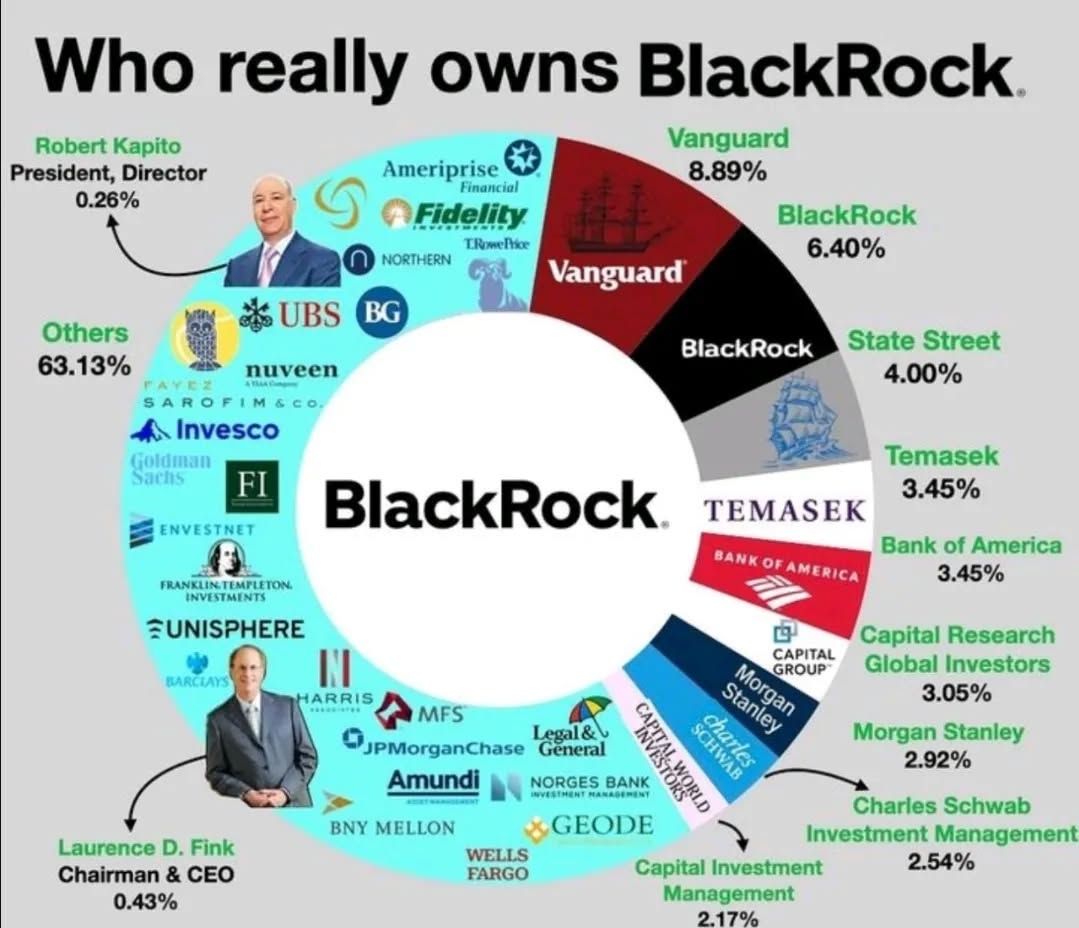

Make no mistake about it, BlackRock is owned by the world’s most powerful people and influential companies.

And they own a lot of things.

BlackRock's assets under management hit a record $13.46 trillion on the third-quarter market rally this year. That is Trillion with a T.

New Jersey’s 350,000-Home Blockchain Program

Gif by election2016 on Giphy

Bergen County, New Jersey, partnered with Balcony on Avalanche in 2025 to migrate about 370,000 property deeds, covering $240 billion in value and $500 million in annual taxes, onto blockchain for secure, auditable records. These cryptographic deed representations focus on fraud reduction and efficiency, forming a legal foundation that could link to financial tokens later.

Two Rails of the Same Future

BlackRock handles the financial product layer with tokenized funds, while New Jersey modernizes the legal title layer, together enabling interoperable ownership and settlement records. As jurisdictions adopt similar systems, fund and deed tokens could automate cash flows and risk, transforming capital formation without speculative home trading.

Cost, Security, and Signal vs. Noise

Tokenization cuts reconciliation costs, auditing, and disputes through immutable ledgers, with real estate tokenization already at $20-33 billion and projected to reach trillions amid regulatory progress. Security addresses real-world issues, such as title challenges, as seen in BlackRock's compliant infrastructure and Bergen County's tamper-evident registry. Moves by BlackRock, Securitize, Avalanche, and counties signal scalable infrastructure over hype. Couple that with their influence and clout, and this is absolutely not noise.

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

What This Means for Founders, LPs, and Operators

• For founders: The infrastructure is live and compliant. If you're building on tokenized rails, whether for fractional ownership, captable automation, or title verification, BlackRock's BUIDL and Bergen County's blockchain registry prove that institutions are willing to deploy at scale. Your go-to-market just got a major credibility boost.

• For LPs: Tokenization isn't speculative anymore, it's institutional infrastructure. BlackRock's $13.46 trillion AUM backing BUIDL signals that real estate tokenization will become a standard part of alternative asset portfolios. Expect faster liquidity, transparent reporting, and lower back-office friction in the funds you back.

• For operators: The two rails are converging. As financial tokens and deed records move onto interoperable systems, your opportunity is in the middleware building tools that connect capital formation, compliance, distribution, and ownership in real time. The companies that solve for this integration layer will capture outsized value as tokenization scales from billions to trillions.

xoxo,

Maximillian Diez

GP, Twenty Five Ventures

P.S. Stay with me on this journey.

If nothing else, thanks for reading.